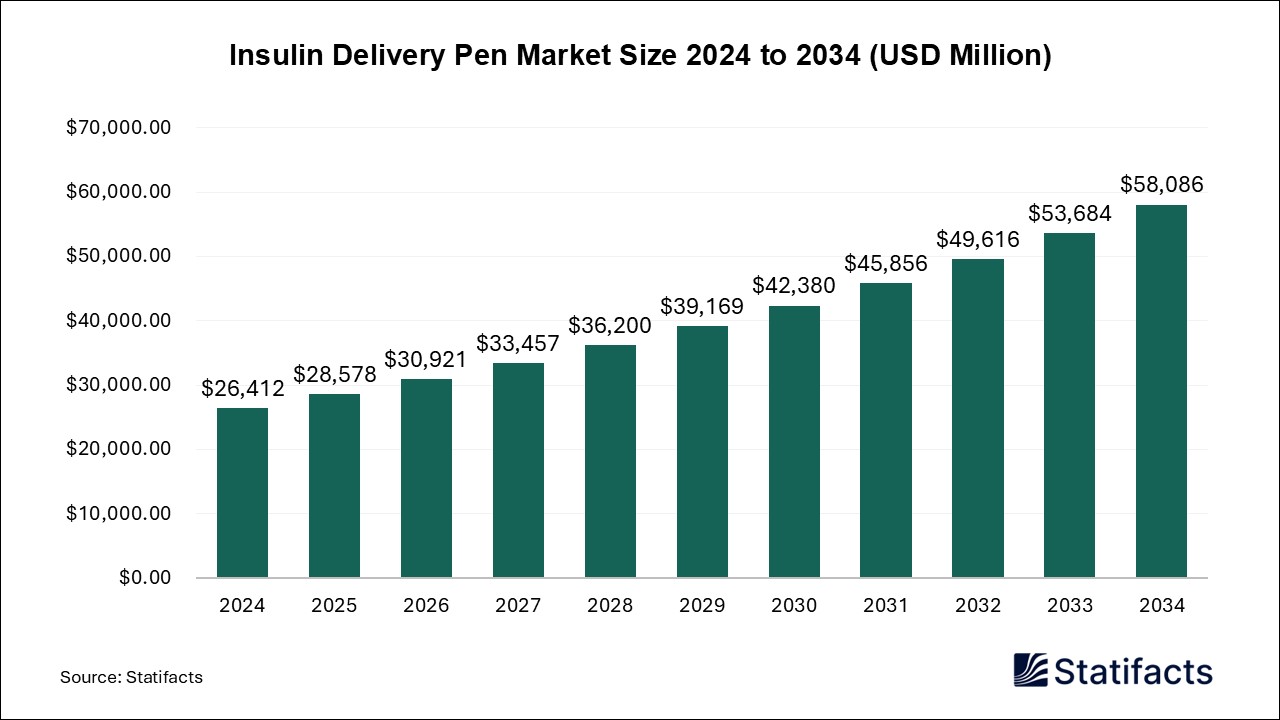

Insulin Delivery Pens Market Size is Estimated to Reach USD 58,086 Mn by 2034

The global insulin delivery pens market size is predicted to increase from USD 25,578 million in 2025 and is anticipated to reach around USD 58,086 million by 2034, expanding at a CAGR of 8.2% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

/EIN News/ -- Ottawa, April 25, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global insulin delivery pens market size was exhibited at USD 26,412 million in 2024 and is projected to grow USD 58,086 million by 2034 with a CAGR of 8.2% during the forecast period from 2025 to 2034. The insulin delivery pens market is growing driven by the increasing senior population, technological advancements in insulin delivery devices, the rising prevalence of diabetes, raising awareness about insulin pen use, and the increasing prevalence of diabetes.

Request a Sample Databook to Explore our Insights@ https://www.statifacts.com/stats/databook-download/7199

Market Overview

Insulin delivery pens are injection devices that allow you to deliver preloaded insulin into your subcutaneous tissue, the innermost layer of skin in your body. Taking insulin pens is more convenient due to they combine the syringe and medication in one handy unit. Compared to vials of insulin and syringes, pens come preloaded with insulin, including premixed insulins, and are easy to use. Pens can be a better option if it is difficult to hold vials of insulin.

The insulin delivery pens market refers to the production, distribution, and use of insulin delivery pens that contain insulin in a cartridge that is administered into subcutaneous tissue through a fine, replaceable needle. Various studies show that insulin pens have enhanced dosing consistency and accuracy compared with syringes. The use of insulin pens can provide many benefits for hospitalized patients, including reduced costs, enhanced safety, and greater satisfaction among healthcare providers and patients.

Advancements in insulin pens help the growth of the market. Smart insulin pens are digital; through the internet, pens automatically share information about the time and amount of insulin received in an injection to an app on our smartphone. The app may have additional functions such as monitoring the insulin expiration date and temperature, sending you alerts if it thinks we may miss an insulin injection, and helping to calculate the insulin amount based on the current blood sugar level.

- In September 2024, to launch a smart app for insulin FlexTouch pens, Mallya, planned by Novo Nordisk Korea. Mallya is designed to work with FlexTouch pens used for treatments like Fiasp, Ryzodeg, Tresiba, and Xultophy and transmits insulin injection data to a mobile app through Bluetooth.

Insulin Delivery Pens Market Key Highlights

- North America led the market with the biggest market share in 2024

- Asia Pacific is predicted to expand the fastest CAGR between 2025 and 2034.

- By technology, the non-smart injectors segment is estimated to hold the highest market in 2024.

- By technology, the smart injectors segment is expected to expand at the fastest CAGR over the projected period 2025 to 2034.

- By product, the disposable insulin pens segment has held the largest market share in 2024.

- By product, the reusable insulin pens segment is anticipated to grow at the fastest rate in the market from 2025 to 2034.

- By distribution channel segment accounted the highest market share in 2024.

- By distribution channel segment is anticipated to grow at the fastest rate in the market from 2025 to 2034.

Major Key Trends in Insulin Delivery Pens Market:

- Adoption of beneficial initiatives: Quality enhancement initiative helps to enhance insulin pen delivery and patient health, and eliminate adverse effects related to insulin pen use. Regular education about safety procedures, with a yearly review for all nurses, will enhance the safety of ongoing insulin pen use in the hospital.

- Rising diabetes care spending: According to a study, near about 11.6% of participants spent over 30% of their yearly income on diabetes care. Episodes of hospitalization, presence of complications, longer duration of diabetes, lower socioeconomic status, being obese, and older age groups were associated with higher healthcare expenditure.

-

Suitable device insurance policies: According to the Congress government, many Americans have coverage for insulin through a health insurance plan, both through the government program and in the commercial market.

Order the Premium Databook Today at the Discounted Rate of $1550! https://www.statifacts.com/order-databook/7199

Limitations & Challenges in the Insulin Delivery Pens Market:

- Strict government regulations: Strict government regulations for insulin delivery pens may lead to limited accessibility, rising costs, and potential delays in advancements.

- High cost of insulin pumps: Structural factors that can lead to higher insulin costs include limited flexibility for the government to arrange drug prices and the need for transparency in arrangements with pharmacy benefit managers.

-

Presence of alternative insulin delivery devices: Alternatives to insulin delivery pens for type 2 diabetes include exercise, weight loss surgery, injectable medications, oral medications, lifestyle changes, and more. Injection ports, injection pumps, insulin jet injectors, and injection aids are also available for alternative ways to deliver insulin.

Development of Insulin Delivery Pens Platforms: Market’s Largest Potential

Using a smart insulin delivery pen platform, data has the potential to enhance insulin delivery. A smart pen is an insulin pen device that is in touch with a mobile app to track insulin delivery, like the time and dose of insulin given. Smart pen techniques include smart attachments/caps or reusable insulin pens that attach to a prefilled and disposable insulin pen.

- In November 2022, the launch of a diabetes platform that tracks blood sugar, and insulin pen use announced by Eli Lilly.

Regional Analysis:

North America held the Dominant Position: Technological Advancement to Support Growth.

North America held the largest share of the insulin delivery pens market in 2024. Due to changing lifestyles, the rate of diabetes cases is high in developed countries like the United States and Canada.

Major Factors for the Market’s Expansion in North America

- In April 2025, the Omnipod 5 automated insulin delivery system in Canada, a revolutionary new technology for people living with type 1 diabetes aged 2 years and above, was launched by the global leader in tubeless insulin pumps technology, Insulet Corporation.

- In February 2023, Ypsomed AG, as the manufacturer and supplier of insulin dosing injector pens for the company’s affordable insulins, was selected by Civica, Inc. Ned McCoy, president and CEO of Civica, said ‘as a renowned injection device specialist with over 35 years’ experience, Ypsomed will help Civica make self-administered care for more affordable Americans living with diabetes.

What Expect from Asian Countries till 2034?

Asia Pacific is projected to host the fastest-growing market in the coming years. Rising demand for advanced insulin injection pens, rising rate of diabetes, and increasing use of digital technologies in insulin delivery systems are driving the growth of the insulin delivery pens market in the Asia Pacific region.

Top Asian Countries for Insulin Delivery Pens Treatment

India: In March 2023, for the diabetes drug ‘Soliqua’ (in pre-filled pen), Sanofi (India) received marketing authorization from the CDSCO (Central Drugs Standard Control Organization). Soliqua aims as a treatment to enhance glycemic control as an adjunct to diet and exercise, in elders with obesity and type 2 diabetes who are poorly controlled on injectable or oral therapies.

Japan: In January 2024, 510(K) clearance was received from the U.S. Food and Drug Administration (FDA) to market SoloSmart, Sanofi’s smart medical device that connects SoloStar insulin pens was announced by a Novo Nordisk company based in France and specialized in the design, development, and manufacturing of innovative medical devices, BIOCORP.

Insulin Delivery Pens Market Scope

| Report Attribute | Key Statistics |

| Market Size in 2025 | USD 28,578 Million |

| Market Size by 2034 | USD 58,086 Million |

| Growth Rate from 2025 to 2034 | CAGR of 8.2% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Technology, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technology Insights

The non-smart injectors held a dominant presence in the market in 2024. Non-smart injectors are the most cost-effective solution, especially in low-income and emerging economies. They are simple to use and reliable, making them accessible in areas where healthcare access and infrastructure. These factors are contributing to their popularity.

The smart injectors segment is projected to experience the highest growth rate in the market between 2025 and 2034. The segment is picking up traction because of the various advantages offered by these smart pens. These smart injectors help track doses automatically, sending reminders to patients, reducing risks of over-dosing or under-dosing. Patients can also use the connected apps and devices to share data with their healthcare providers, allowing for better tracking and improving patient-outcomes.

Product Insights

The disposable insulin pens segment held a dominant presence in the insulin delivery pens market in 2024. Advanced disposable insulin pen systems provide an alternative to syringes and vials for the administration of insulin. Disposable insulin pens meet criteria for safety, dosing accuracy, and ease of use.

The reusable insulin pens segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The newer, reusable insulin pens provide a key benefit of correcting a selected dose without losing insulin as compared to traditional methods. We can store unopened pens in the refrigerator. They are good until the expiration date. Many pens are good for 28 days once we open them.

- In July 2022, to launch the first reusable insulin pen injector ‘TouStar’, proving that sustainable medicine delivery devices are gaining ground, designed by DCA and manufactured by Sanofi.

Distribution Channel Insights

The hospital pharmacies segment accounted for a considerable share of the insulin delivery pens market in 2024. The hospital pharmacy's primary mission is the use of medication management in hospitals and other medical centers. Aims of hospital pharmacy include selection, prescription, procurement, delivery, administration, and review of medications to improve patient outcomes.

The retail pharmacies segment is projected to experience the highest growth rate in the market between 2025 and 2034. Retail pharmacies are responsible for the correct dispensing of medication for customers to use at home, as well as educating the customers on their medications and answering any questions the customers have. This pharmacy offers services like personalized counseling on medication use, immunizations, and health screenings.

Browse More Research Reports:

- The global non-injectable insulin market size accounted for USD 1,800 million in 2024 and is expected to exceed around USD 6,440 million by 2034, growing at a CAGR of 13.6% from 2024 to 2034.

- The U.S. medical devices market size is calculated at USD 188.71 billion in 2024 and is predicted to reach around USD 367.77 billion by 2034, expanding at a CAGR of 6.9% from 2024 to 2034.

- The global wearable medical devices market size accounted for USD 42.71 billion in 2024 and is expected to exceed around USD 430.76 billion by 2034, growing at a CAGR of 26% from 2024 to 2034.

- The global respiratory device market size is calculated at USD 26,878 million in 2024 and is predicted to reach around USD 69,715 million by 2034, expanding at a CAGR of 10% from 2024 to 2034.

- The global neurovascular device market size accounted for USD 3,200 million in 2024 and is predicted to touch around USD 4,220 million by 2034, growing at a CAGR of 2.8% from 2024 to 2034.

- The global single-use pump market size surpassed USD 488 million in 2024 and is predicted to reach around USD 1,701 million by 2034, registering a CAGR of 13.3% from 2025 to 2034.

Order the Premium Databook Today at the Discounted Rate of $1550! https://www.statifacts.com/order-databook/7199

Insulin Delivery Pens Market Top Companies:

- Eli Lilly and Company

- Becton, Dickinson & Company

- West Pharmaceutical Services, Inc

- Johnson & Johnson

- Antares Pharma

- AbbVie Inc.

- Pfizer Inc

- Mylan N.V

- Vetter Pharma-Fertigung GmbH & Co.KG

- Emperra GmbH

- Digital Medics Pty Ltd

- Enable Injections LLC

- Thermo Fisher Scientific Inc.

Recent Breakthroughs in the Global Insulin Delivery Pens Market:

- In March 2025, a probe into insulin pen manufacturers Novo Nordisk and Sanofi Aventis for possible anticompetitive practices was launched by the SA’s competition authority.

- In November 2024, setting the stage for the launch of the Company’s Smart MDI system integrated with Simplera continuous glucose monitor (CGM), the US Food and Drug Administration (FDA) has granted clearance to Medtronic’s new InPen app, in an advancement for diabetes management.

Segments Covered in the Report

By Product

- Reusable Insulin Pens

- Disposable Insulin Pens

- Smart Insulin Pens

By Technology

- Non-Smart Injectors

- Smart Injectors

By Distribution Channel

- Hospital Pharmacies

- Drug Stores

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

You can Place an Order or Ask any Questions, Please Feel Free to Contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Distribution channels: Consumer Goods ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release