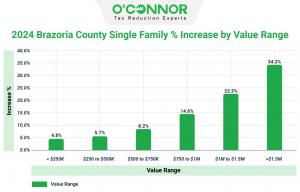

BCAD Boosted Average Home Values By 7%, But High-Value Residential Property Are Hit With Huge Increases

O'Connor concluded that while the BCAD elevated average home values by 7%, high-value residential properties faced substantial increases.

HOUSTON, TEXAS, UNITED STATES, May 20, 2024 /EINPresswire.com/ -- The latest assessment of Brazoria County real estate market unveils substantial shifts in residential property values across various price brackets. Properties valued above $1.5 million witnessed an impressive 34% growth, signaling a continuous upward trajectory in the luxury market segment. Similarly, homes priced between $1 million and $1.5 million saw a significant 22.5% surge in value. Conversely, properties valued below $250,000 saw a smaller increase, rising by $244 million from their 2023 value, marking a 4.8% increase in value.

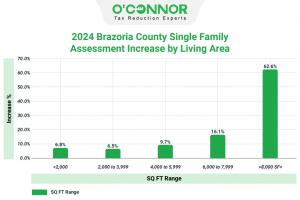

Brazoria County’s Property Values in 2024 Impact Large Homes Most

In 2024, Brazoria County experienced considerable shifts in property values, with an overall 7% increase, soaring from $36 billion to $39 billion. Remarkably, high-value homes exceeding 8,000 square feet surged by an impressive 62.6%. Conversely, single-family residences spanning 2,000 to 3,999 square feet saw the smallest increase, rising collectively by 6.5% from $21 billion to nearly $23 billion.

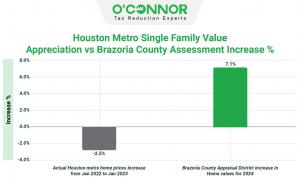

BCAD’s Unexpected Rise Contrasts with Houston Metro’s Downturns

According to recent updates, the Brazoria County Appraisal District implemented an average 7% increase in home values during the 2024 property tax reassessment period. However, data from the Houston Metro source revealed a 2.5% decline from January 2023 to January 2024 for local residential property sales.

Tax Assessments in Brazoria County Saw an Increase in Property Built Following the Year 2001.

In the 2024 property tax reappraisals overseen by the Brazoria County Appraisal District, newer homes constructed after 2001 in Brazoria County received slightly higher assessments compared to older counterparts. These newer properties saw an uptick of 8.4%, while those built between 1981 and 2000 experienced a more subdued growth of 4.8%. Overall, according to Brazoria County Appraisal District data, home values in the county increased by 7% based on construction year categorization.

64% of Brazoria County Properties Were Assessed at Values Exceeding Their Actual Worth.

During 2024, the Brazoria County Appraisal District overvalued 64% of properties, totaling 3,508 accounts, whereas research contrasting 2023 house sale prices with 2024 property tax reassessments unveiled that 36% of properties, equating to 1,987 accounts, had sale prices meeting or falling below the 2023 assessed market value.

Key Points from BCAD’s 2024 Property Tax Revaluation

Property owners in BCAD are experiencing notable rises in property values, particularly in luxury residential properties, outpacing growth in the Harris metro area. It’s essential for Texas property owners, especially those in Brazoria County, to recognize their legal rights and the importance of challenging their property’s assessed value.

With evidence to support their claims throughout the appeal process, residential property owners should strongly consider filing an appeal or seeking assistance from a property tax consulting firm, as most protests result in favorable outcomes. With fifty years of experience in the real estate industry, O’Connor is well-equipped to assist in the fight for reduced residential and commercial property taxes, dedicated to improving property owners’ lives by effectively lowering taxes.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.